It may be June but for many advertisers and agency planners Christmas is already top of mind. A focus on planning the perfect golden quarter for retailers, grocers and gifting category brands starts early.

To help those forming their plans now or later in the year, we’ve put together a planning guide for the most wonderful time of the year. As the home of festive audiences and celebratory, seasonal content, we offer brands scaled reach to millions of readers as they research, plan and seek inspiration to enjoy the perfect Christmas.

From Christmas shopping and gifting ideas to tips on festive fun and feasting, our guide provides insight into the categories, topics and audiences that will add a little Ozone sparkle to your Q4 plans.

A normal Christmas

Christmas 2023 promises the first normal festive season in three years. The Covid-19 emergency is officially over, according to the World Health Organisation and there’s no winter World Cup football to dilute attention. However, the cost of living crisis continues to inflict budgetary pressure on consumers. Whether prices will fall significantly by Q4 is still unclear.

With that in mind, we can expect a return to some sort of normality in terms of consumer behaviour this Christmas as the early birds, deal hunters and last-minute shoppers engage with our festive content.

Increasingly we see engagement with our Christmas Shopping content start earlier than Q4 as the early birds start preparation. In the past two years, September has seen engagement with the Christmas Shopping topic grow by more than 4x month on month. It’s no surprise that this early engagement growth accelerates quite significantly throughout Q4, with Black Friday and other mega-sales key for deal hunters. By the time December arrives, when the last-minute shoppers make a final dash for it, Christmas Shopping page views are, on average, nearly 8x higher versus September.

Importance of mega sales

In 2022, November’s mega sales, including Singles’ Day, Black Friday, Cyber Monday, presented cash-strapped Brits with the opportunity to bag a bargain or two during the cost of living crisis. Rather than diminishing in their importance, with some retail commentators predicting a ‘Bleak Friday’, transaction volumes actually increased. According to Barclaycard, which claims to process nearly £1 in every £3 spent on credit and debit cards in the UK, Black Friday payment transactions were up by almost 4% vs. 2021.

This increased interest is something we also saw in our audience engagement data. Even with England matches during the promotional period last year, Shopping page views grew +5% year on year in the week of Black Friday. Our premium publishers offer our readers well researched, category-by-category lists of the best deals and promotions, which helps to inspire the shopping choices our online readers make.

December weekdays are key for last minute shoppers

An interesting trend we spotted last December may indicate a much more hybrid approach to shopping behaviour for shoppers this year. With bricks and mortar retailers closed or partially closed in 2020 and 2021, ecommerce businesses and online retailers offering delivery were clear pandemic winners. However, last December, with physical stores back in real life, consumers had more time to research and consider items online first before making their purchases either online or in store.

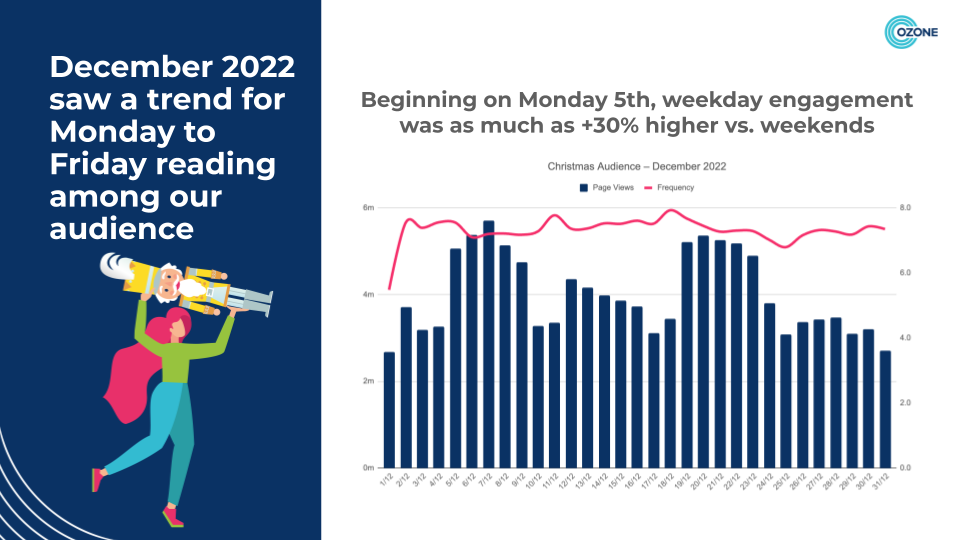

Looking at the behaviour of our Christmas audience segment in December 2022, we spotted a strong preference for Monday to Friday reading among them. Beginning on Monday, 5 December, weekday engagement was as much as +30% higher when compared to weekends, suggesting our audience engaged with relevant Christmas content online during the week for inspiration before visiting stores at the weekend to complete their transaction. That’s certainly a consideration for brands in December 2023.

Reach millions more consumers this Christmas

Brands can currently reach more than 80% of our total audience – or 35m online readers – using our bespoke, behavioural Christmas, Black Friday and Main Shopper audience.

Thinking about the huge growth in engagement with Christmas Shopping content we’ve seen in the past two years, and the import cost savings November’s mega-sales bring to consumers, we can expect our overall audience reach to rise significantly in Q4 2023.

Want to know more?

To get Christmas wrapped up early with Ozone, download our latest festive insight report below, drop us a line at [email protected] or speak to your agency representative.

Discover more with Ozone Ad Manager

If you want access to MORE unique insight like this at your fingertips, sign up to Ozone Ad Manager FOR FREE to explore the content consumption habits of our nationwide audience of 43m internet users.

Ozone Ad Manager is exclusively available to our agency and advertiser partners. First-time users of the platform can sign up to register to use it here oam.ozoneproject.com.

About Ozone Ad Manager

-

Explore more than 1,400 audiences from across a wide-range of interest-based categories and understand content trends from across 1,200 topics.

-

Activate campaigns using seasonal segments, such as Easter and Christmas, or specially created ones like Cost of Living, Environmentally Conscious and Luxury Lifestyles.

-

Create and then share bespoke audiences or deal details with other users within your agency to streamline your campaign processes with us.