Frances Lazenby, senior strategist at Ozone, delves into how consumers are engaging with travel content in a post-COVID world and the trends we see through their current reading patterns.

Although a much overused word for 2020, ‘unprecedented’ is the only way to describe the disruption to the travel industry as a result of the pandemic. I doubt anyone could have anticipated the closed borders, grounded flights and sudden halt to travel plans that 2020 has brought on a global scale.

The introduction of travel restrictions and ever-changing quarantine rules has clearly had a massive impact on the sector, while at the same time creating huge frustration among travellers - from package holiday seekers to those going off the beaten track - who have found themselves in a more constricted, controlled and even inaccessible world than the one that existed in 2019.

Thankfully the situation looks like it’s improving from what we experienced in the spring - despite some ongoing changes in government travel restrictions. From our reader data we can see a really positive correlation between the easing of lockdown measures and the increase in travel content consumption over the past few months, with user engagement already returning back up to pre-Covid levels. Furthermore, and somewhat surprisingly, as much as 75% of travel content consumed is not actually related to Coronavirus at all, proving that people are getting excited about the prospect of travelling again.

Looking deeper into the broader subtopics of travel it is clear that as people moved out of lockdown their focus was finding inspiration for their next trip. This consumption shows that while not everyone is ready to travel right away, they are at the very least in inspiration mode for their future travels - all pointing to this being an important time for brands to build awareness and consideration.

Consumption of travel content peaks at times when users are looking for distraction or combatting the Monday blues, with spikes in engagement occuring on Monday evenings and Fridays just before the working day ends (as shown by the green boxes on the chart below). Tuesdays then see a comparative dip as the working week really gets started. This pattern is particularly interesting when we consider that the majority of the travel industry sees bookings spike during the weekend - our data proves that for brand building the best time to reach inspired users is during the working week.

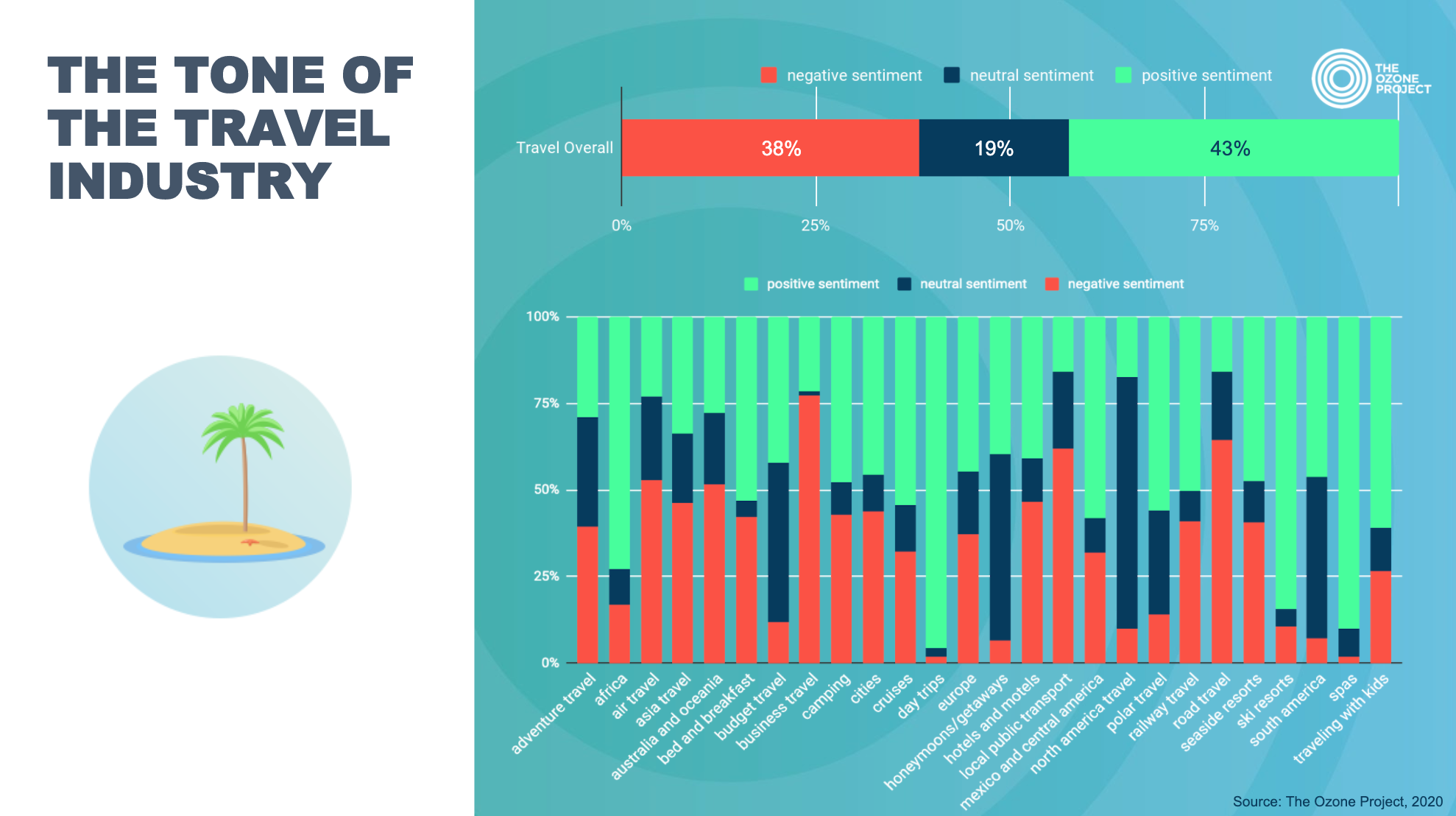

Using our proprietary word classification technology we are able to analyse the extent to which publisher content is of a positive, neutral or negative sentiment. From our analysis you can see, perhaps surprisingly, that the tone of travel content across the UK errs towards the positive. This data, combined with the fact we know that just 25% of our travel content is about Coronavirus further proves that now is the time people are looking to be inspired. As we drill down into travel content of course there are some areas that are more positive than others, for example ski trips and family holidays skewing a lot more positively than air travel and business travel.

If we look at the difference in engagement between articles on long haul, short haul and domestic travel, there are clear links between engagement and key milestones in the Government's announcements regarding travel. For example, both long haul and short haul content spiked on the 13th July, which marks the day the Government allowed all remaining shops and services to reopen, showing that this move will have triggered a new found optimism amongst the UK population as more measures eased. Similarly the 27th July was the day the Government advised against all non-essential travel to Spain, which created an enormous spike in interest in content on short haul travel.

As COVID-friendly travel becomes more commonplace, we expect reader interest in reviews, travel guides and getaway recommendations to continue to strengthen, particularly as the need for inspiration shifts to a need for a change of scene.

With near universal reach of all UK adults, our reader insights provide a content-driven barometer for real-life consumer behaviours. If you’d like to find out more, drop us a line here.